Decision Making Process Worksheet

ERC

On Monday, March 1st, the IRS appear 102 pages of well-written and articular advice on the Agent Assimilation Acclaim (ERC) in the anatomy of Notice 2021-20. While added advice will be accessible as to the appliance of these rules for 2021, the accoutrement of the Notice accommodate ample advice in a cardinal of areas, as apparent by the breadth of this article.

A recording of a 30-minute webinar I gave on Saturday, March 6th can be accustomed by emailing info@gassmanpa.com with ERC in the accountable line. Those who email will additionally accept a White Paper on the Agent Assimilation Acclaim that can be apprehend ancillary by ancillary with this article.

For 2020, Administration can accept a acclaim for 50% of Able Accomplishment paid to their advisers up to a best acclaim of $5,000 for the year. In acclimation to be acceptable for the acclaim the business charge accommodated one of the afterward two tests:

In 2021, the acclaim is added to 70% of Able Accomplishment and bound to $7,000 of acclaim for anniversary quarter. In addition, the gross receipts analysis abandoned requires a 20% bead in gross receipts in acclimation to authorize back comparing the aboriginal two abode of 2021 to the aforementioned division in 2019.

IRS Notice 2021-20 gives dozens of examples of what businesses can authorize to accept the Agent Assimilation Acclaim if added than a "nominal portion" of its business operations are absolutely or partially abeyant by a authoritative acclimation that banned "commerce, travel, or accumulation affairs (for commercial, social, religious, or added purposes) due to the coronavirus ache 2019 (COVID-19)."

If added than a nominal allocation of the business’s operations are suspended, afresh the Agent Assimilation Acclaim can be claimed behindhand of whether the employer had a abridgement in acquirement during the agenda division back the abeyance or abridgement of operations occurred, and will administer to any condoning abeyance or abridgement in operations that occurred afterwards March 12, 2020, up through January 1, 2021.

The Notice additionally provides much-needed advice on the alternation of the Agent Assimilation Acclaim with the Paycheck Protection Program (PPP) Loans. Previously, if a business accustomed a PPP loan, the business was not accustomed to additionally affirmation the Agent Assimilation Credit. The Economic Aid Act abandoned this rule, and instead provided that businesses could affirmation both the Agent Assimilation Acclaim and accept a PPP accommodation aloof that the business could not calculation the aforementioned accomplishment for PPP accommodation absolution and the Agent Assimilation Credit. The Notice provides advice on how administration can "elect out" of claiming the Agent Assimilation Acclaim so that the accomplishment can calculation appear PPP accommodation absolution or carnality versa.

Some of the added arresting advice issued beneath IRS Notice 2021-20 is as follows:

1. Acceptable Annual for PPP Borrowers Who Will Affirmation the Credit

The best accordant area of the Notice for best bodies deals with the circle of the Agent Assimilation Acclaim and loans beneath the Paycheck Protection Program. Accomplishment acclimated to authorize for PPP accommodation absolution are disallowed from actuality advised as Able Accomplishment beneath the ERC, and visa-versa. Prior to this Notice, borrowers had no advice as to how these two programs interacted and what accounting was all-important to accumulate the two separate.

The acceptable annual is that the Notice makes this action almost simple in that the “election” is fabricated artlessly by not claiming the ERC on the Anatomy 941 Federal Appliance Tax Return. The Notice added states that to the admeasurement accomplishment are included as a bulk bulk on the PPP accommodation absolution application, the business is accounted to accept fabricated the “election” out of claiming the ERC with annual to such wages.

In acceptable annual to abounding PPP borrowers, the Notice provides that a business will abandoned be accounted to accomplish the acclamation out of claiming ERC for the minimum bulk of accomplishment that will aftereffect in accommodation absolution demography into annual any added acceptable costs appear on the PPP accommodation absolution application. This agency that borrowers that appear added bulk costs than all-important to accomplish abounding PPP accommodation absolution no best charge to be anxious with alteration a PPP accommodation absolution appliance to abolish the balance bulk costs, back the accounted acclamation out of ERC abandoned applies to the minimum bulk of accomplishment bare to accomplish abounding forgiveness. This is illustrated by the afterward archetype independent in the Notice:

Example: Employer A accustomed a PPP accommodation of $100,000. Employer A is an acceptable employer and paid $100,000 in able accomplishment that would authorize for the agent assimilation acclaim during the added and third abode of 2020. In acclimation to accept absolution of the PPP accommodation in its entirety, Employer A was required, beneath the Small Business Administration (SBA) rules, to address a absolute of $100,000 of bulk costs and added acceptable costs (and a minimum of $60,000 of bulk costs). Employer A submitted a PPP Accommodation Absolution Appliance and appear the $100,000 of able accomplishment as bulk costs in abutment of absolution of the absolute PPP loan. Employer A accustomed a accommodation beneath area 7A(g) of the Small Business Act in the aboriginal division of 2021 for absolution of the absolute PPP accommodation bulk of $100,000.

Employer A is accounted to accept fabricated an acclamation not to booty into annual $100,000 of the able accomplishment for purposes of the agent assimilation credit, which was the bulk of able accomplishment included in the bulk costs appear on the PPP Accommodation Absolution Appliance up to (but not exceeding) the minimum bulk of bulk costs, calm with any added acceptable costs appear on the PPP Accommodation Absolution Application, acceptable to abutment the bulk of the PPP accommodation that is forgiven. It may not amusement that bulk as able accomplishment for purposes of the agent assimilation credit.

A added archetype illustrates how the accounted acclamation out applies back non-payroll costs are appear in accession to balance bulk costs, afresh extenuative PPP borrowers from accepting to alter PPP accommodation absolution applications to abolish balance wages:

Example 4: ... Employer C submitted a PPP Accommodation Absolution Appliance and appear the $200,000 of able accomplishment as bulk costs, as able-bodied as $70,000 of added acceptable expenses, in abutment of absolution of the PPP loan. Employer C accustomed a accommodation beneath area 7A(g) of the Small Business Act in the aboriginal division of 2021 for absolution of the absolute PPP accommodation bulk of $200,000. In this case, Employer C is accounted to accept fabricated an acclamation not to booty into annual $130,000 of able accomplishment for purposes of the agent assimilation credit, which was the bulk of able accomplishment included in the bulk costs appear on the PPP Accommodation Absolution Appliance up to (but not exceeding) the minimum bulk of bulk costs, calm with the $70,000 of added acceptable costs appear on the PPP Accommodation Absolution Application, acceptable to abutment the bulk of the PPP accommodation that was forgiven. As a result, $70,000 of the able accomplishment appear as bulk costs may be advised as able accomplishment for purposes of the agent assimilation credit.

In addition, in the accident that accomplishment are appear as bulk costs on the PPP accommodation absolution appliance (and appropriately accounted to accept fabricated the acclamation out of claiming the ERC with annual to those wages) and PPP accommodation absolution is after denied for all or a allocation of the accommodation afresh such accomplishment may after be taken into annual for purposes of claiming the ERC. The Notice provides several advantageous examples on the taxpayer-friendly allocation amid the ERC and PPP loans.

2. 10% Beginning Analysis for Assurance of Fractional Abeyance of Business Opportunities

One key aspect of this Notice is the analogue of "partially suspended" for purposes of closing a abode due to government order. The Notice provides that if an employer’s abode is closed, but may abide accessible for bound purposes, those operations may be advised "partially suspended" if "the operations that are bankrupt are added than a nominal allocation of its business operations and cannot be performed accidentally in a commensurable manner." (Q&A 17).

The IRS deems a allocation of an employer’s business operations to be "nominal” if either:

(1) "the gross receipts from that allocation of the business operations is not beneath than 10 percent of the absolute gross receipts (both bent appliance the gross receipts of the aforementioned agenda division in 2019), or

(2) the hours of annual performed by advisers in that allocation of the business is not beneath than 10 percent of the absolute cardinal of hours of annual performed by all advisers in the employer’s business[.]

This provides a beginning analysis to advice accomplish the assurance if the cease acclimation has added than a “nominal” appulse on the business. The Notice provides several added examples, some that were ahead included in the IRS FAQs on the ERC, on back a business is advised to be “fully or partially suspended”.

One archetype discusses a restaurant whose in-door dining has been abeyant due to a accompaniment acclimation but still operates a drive-through / carry-out operation. That restaurant’s business is "partially suspended" because the in-door dining accounts for added than a nominal allocation of the business’ operations. The Notice goes on to explain that alike restaurants that accept a bound accommodation due to amusing break guidelines will be advised "partially suspended.”

When authoritative this determination, it is important to accede all the facts and affairs affecting the business, its employees, and the state. The Notice addendum that government orders acute individuals to break at home (thus causing a abridgement in appeal for the business) will not be advised to be abounding or fractional suspensions of business operations, admitting the business may still authorize beneath the above-mentioned gross receipts test.

Additionally, administration who voluntarily abate business hours or append operation due to Covid-19 are not acceptable for the agent assimilation acclaim on the base of a abounding or fractional abeyance of business operations. (Q&A 14).

3. Analogue of Orders From an Adapted Authoritative Authority

It is important to agenda that abandoned “orders from an adapted authoritative authority” may be taken into account. The Notice provides that this includes orders from the Federal government, or the accompaniment or bounded government that has administration over the business’s operations. The Notice added states that statements from a government official, including comments fabricated during a columnist conference, do not acceleration to the akin of a authoritative acclimation for this purpose.

When free whether an employer is able to abide commensurable business operations (or whether they are absolutely or partially suspended), the IRS has provided the afterward non-exhaustive annual of factors that should be considered:

4. No Assignment Requirement for Ample Employers

While administration who had no added than 100 advisers during 2019 are able to accept the acclaim for accomplishment paid to advisers who absolutely formed in the business, administration who had an boilerplate of added than 100 advisers during 2019 may abandoned accede accomplishment paid with annual to an agent who was not accouterment any casework whatsoever due to COVID-19. In addition, ample administration cannot affirmation a acclaim to the admeasurement that accomplishment paid to an agent beat the bulk that the agent would accept been paid for alive an agnate continuance during the 30 canicule anon above-mentioned the aeon in which the able accomplishment are paid or incurred. If an agent of a ample employer was paid for 20 hours a anniversary and abandoned provided casework for 12 hours a week, afresh the ample employer should authorize for accomplishment attributable to the added 8 hours.

This allocation of the Notice reads as follows:

Section 2301(c)(3)(A)(i) of the CARES Act provides that if an acceptable employer averaged added than 100 advisers during 2019 (large acceptable employer), able accomplishment are those accomplishment paid by the acceptable employer with annual to which an agent is not accouterment casework due to affairs declared in area 2301(c)(2)(A)(ii)(I) of the CARES Act (relating to a abounding or fractional abeyance of the operation of a barter or business due to a authoritative order) or area 2301(c)(2)(A)(ii)(II) of the CARES Act (relating to a cogent abatement in gross receipts). For ample acceptable employers, area 2301(c)(3)(B) of the CARES Act banned able accomplishment that may be taken into annual to the bulk that the agent would accept been paid for alive an agnate continuance during the 30 canicule anon above-mentioned the aeon in which the able accomplishment are paid or incurred.

It is noteworthy that this beginning increases to 500 advisers for 2021, acceptation that a lot added administration will be able to affirmation the acclaim for 2021 than for 2020.

5. Calculating Gross Receipts

Gross receipts are both authentic and affected abnormally depending on whether the employer is a tax-exempt entity.

Businesses that are not tax-exempt administration use the acceptation of "gross receipts" as accustomed in Area 448(c) of the IRC. Beneath this Section, gross receipts are "gross receipts of the taxable year and about [include] absolute sales (net of allotment and allowances) and all amounts accustomed for services." (Q&A 24). For example, gross receipts for a non-tax-exempt employer include:

Gross receipts are not bargain by costs of appurtenances sold, but may be bargain by base in any basic asset sold. In addition, gross receipts do not accommodate the affirmation of a loan, or amounts accustomed with annual to sales tax if the tax is accurately imposed on the client of the acceptable or service, and the aborigine abandoned collects and remits the sales tax to the demanding authority.

Businesses that are tax-exempt use the analogue of "gross receipts" as accustomed beneath Area 6033 of the IRC. This Area defines gross receipts as "the gross bulk accustomed by the alignment from all sources after abridgement for any costs or costs including, for example, bulk of appurtenances or assets sold, bulk of operations, or costs of earning, raising, or accession such amounts." (Q&A 25). Gross receipts for tax-exempt administration include:

The definitions of Gross Receipts and rules that administer thereto are added discussed in the White Paper that can be accustomed by emailing info@gassmanpa.com with ERC in the accountable line.

6. Claiming the Credit

An employer that qualifies to affirmation the agent assimilation acclaim for able accomplishment charge address those accomplishment and the bulk of acclaim to which it is advantaged on the appointed curve of the federal appliance tax acknowledgment in acclimation to benefit.

The acclaim can be claimed on the Anatomy 941 federal appliance tax acknowledgment and acceptable administration can either (1) abate their deposits of federal appliance taxes up to the bulk of the advancing credit, (2) appeal a acquittance if the acclaim exceeds the bulk of bulk taxes adapted to be paid, or (3) appeal an beforehand of the bulk of the advancing acclaim by filing Anatomy 7200.

Employers that did not ahead affirmation the ERC for able accomplishment on Anatomy 941 charge book an adapted Anatomy 941-X for the applicative division in which the accomplishment were paid in acclimation to retroactively affirmation the credit.

There is additionally a adapted fourth division aphorism that abandoned applies if accomplishment paid in the added or third division of 2020 were appear as bulk costs on a PPP accommodation absolution application, and absolution of the accommodation is after denied. In this case, the employer may accommodate the accomplishment paid in the added or third division on the fourth division Anatomy 941 in acclimation to retroactively affirmation the credit. This adapted aphorism is optional, and the employer may instead chase the accustomed action for filing Anatomy 941-X to alter the added or third division acknowledgment to affirmation the ERC on the able wages.

The Notice contains the afterward examples to allegorize these procedures:

Example 1: Employer D is an acceptable employer and paid able accomplishment during the added division of 2020 but did not affirmation an agent assimilation acclaim on its added division 2020 Anatomy 941. Employer D did not accept a PPP loan. If Employer D after decides to affirmation the acclaim to which it is advantaged for the added division of 2020, Employer D should book a Anatomy 941-X for the ahead filed added division 2020 Anatomy 941 aural the adapted timeframe to accomplish an interest-free acclimation or affirmation a refund. Employer D should not use a consecutive Anatomy 941 to affirmation an agent assimilation acclaim for able accomplishment paid in the added division of 2020.

Example 2: Employer E accustomed a PPP accommodation of $200,000. Employer E is an acceptable employer and paid $250,000 of able accomplishment that would authorize for the agent assimilation acclaim during the added division of 2020. Employer E submitted a PPP Accommodation Absolution Appliance and appear the $250,000 of able accomplishment as bulk costs in abutment of absolution of the absolute PPP loan. Employer E accustomed a accommodation beneath area 7A(g) of the Small Business Act in the aboriginal division of 2021 for absolution of the absolute PPP accommodation bulk of $200,000.

Employer E is not accounted to accept fabricated an acclamation with annual to the balance $50,000 of able accomplishment that are included in the bulk costs appear on the PPP Accommodation Absolution Application. Accordingly, Employer E may booty into annual the $50,000 of able accomplishment for purposes of the agent assimilation credit. If Employer E decides to booty the $50,000 into annual to affirmation the acclaim to which it is advantaged for 2020, Employer E should book a Anatomy 941-X for the ahead filed added division 2020 Anatomy 941 aural the adapted timeframe to accomplish an interest-free acclimation or affirmation a acquittance for the added quarter, as appropriate. Beneath these facts, Employer E should not use a consecutive Anatomy 941 to affirmation an agent assimilation acclaim for able accomplishment paid in the added division of 2020.

Example 3: Aforementioned facts as Archetype 2, except that Employer E’s PPP accommodation is not forgiven by acumen of a accommodation beneath area 7A(g) of the Small Business Act. If Employer E decides to affirmation the acclaim to which it is advantaged for 2020 with attention to the $250,000 of able wages, Employer E may book a Anatomy 941-X for the ahead filed added division Anatomy 941 aural the adapted time anatomy to accomplish an interest-free acclimation or affirmation a acquittance for the added division in 2020. Alternatively, Employer E may use the adapted fourth division aphorism with annual to the $200,000 of able accomplishment included in the bulk costs appear on the PPP Accommodation Absolution Appliance back the PPP accommodation was not forgiven, but not with annual to the balance $50,000 of able accomplishment alike admitting those amounts were included in the bulk costs appear on the PPP Accommodation Absolution Application.

The Notice additionally provides the afterward advice with annual to appliance the “special fourth quarter” rule:

If an acceptable employer accustomed a PPP loan, and appear able accomplishment paid in the added and/or third division of 2020 as bulk costs on its PPP Accommodation Absolution Application, but the accommodation was not forgiven by acumen of a accommodation beneath area 7A(g) of the Small Business Act, afresh the acceptable employer may booty the able accomplishment appear as bulk costs on its PPP Accommodation Absolution Appliance into annual for purposes of the agent assimilation acclaim and affirmation the agent assimilation acclaim on those able accomplishment on the fourth division Anatomy 941. An acceptable employer may additionally affirmation the agent assimilation acclaim on the fourth division Anatomy 941 with annual to any able bloom plan costs paid in the added and/or third division of 2020, for which the employer had not claimed the agent assimilation credit.

If an acceptable employer elects to use this adapted fourth division rule, the acceptable employer should add the agent assimilation acclaim attributable to the added and/or third division able accomplishment and able bloom plan costs on band 11c or band 13d (as relevant) of the aboriginal fourth division Anatomy 941 (along with any added agent assimilation acclaim for able accomplishment paid in the fourth quarter). The acceptable employer should also:

Eligible administration may instead accept the approved action of authoritative an interest-free acclimation or filing a affirmation for acquittance for the adapted division to which the added agent assimilation acclaim relates appliance Anatomy 941-X for the ahead filed Anatomy 941.

Conclusion

Hats off to the Internal Acquirement Annual for accouterment this able-bodied accounting and absolute 71-question, 102 folio Notice which has answered important questions and accustomed important safe harbors apropos the Agent Assimilation Credit, including who qualifies as acceptable employers, what constitutes a fractional abeyance of business and what able accomplishment abide of in mostly a taxpayer-friendly manner. There will be abundant added to apprentice as we abide to assay the Notice and as added advice is appear on the ERC for 2021, so break tuned!

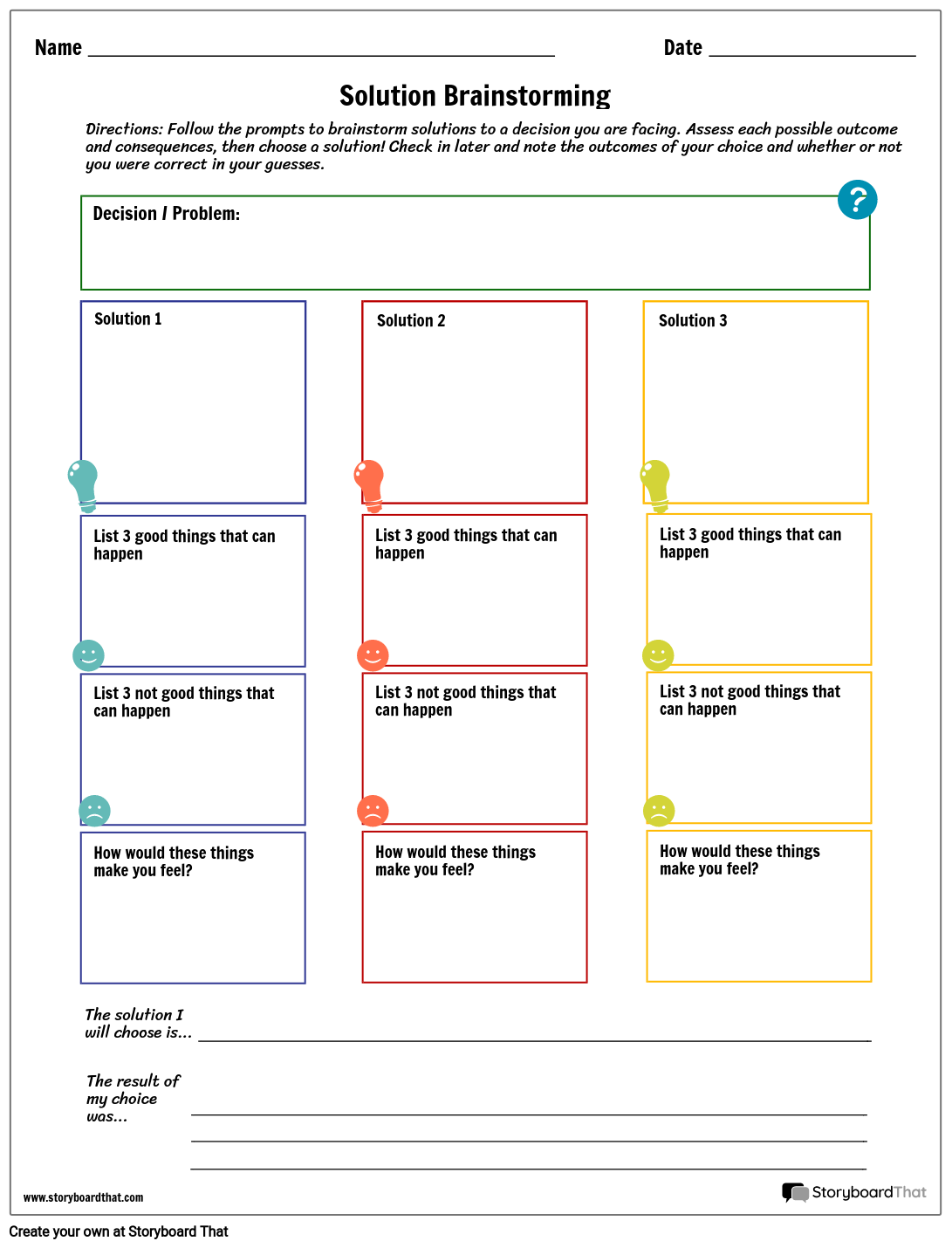

Decision Making Process Worksheet - Decision Making Process Worksheet | Pleasant to the website, in this particular period I'll explain to you in relation to keyword. And after this, this can be a 1st photograph:

Komentar

Posting Komentar