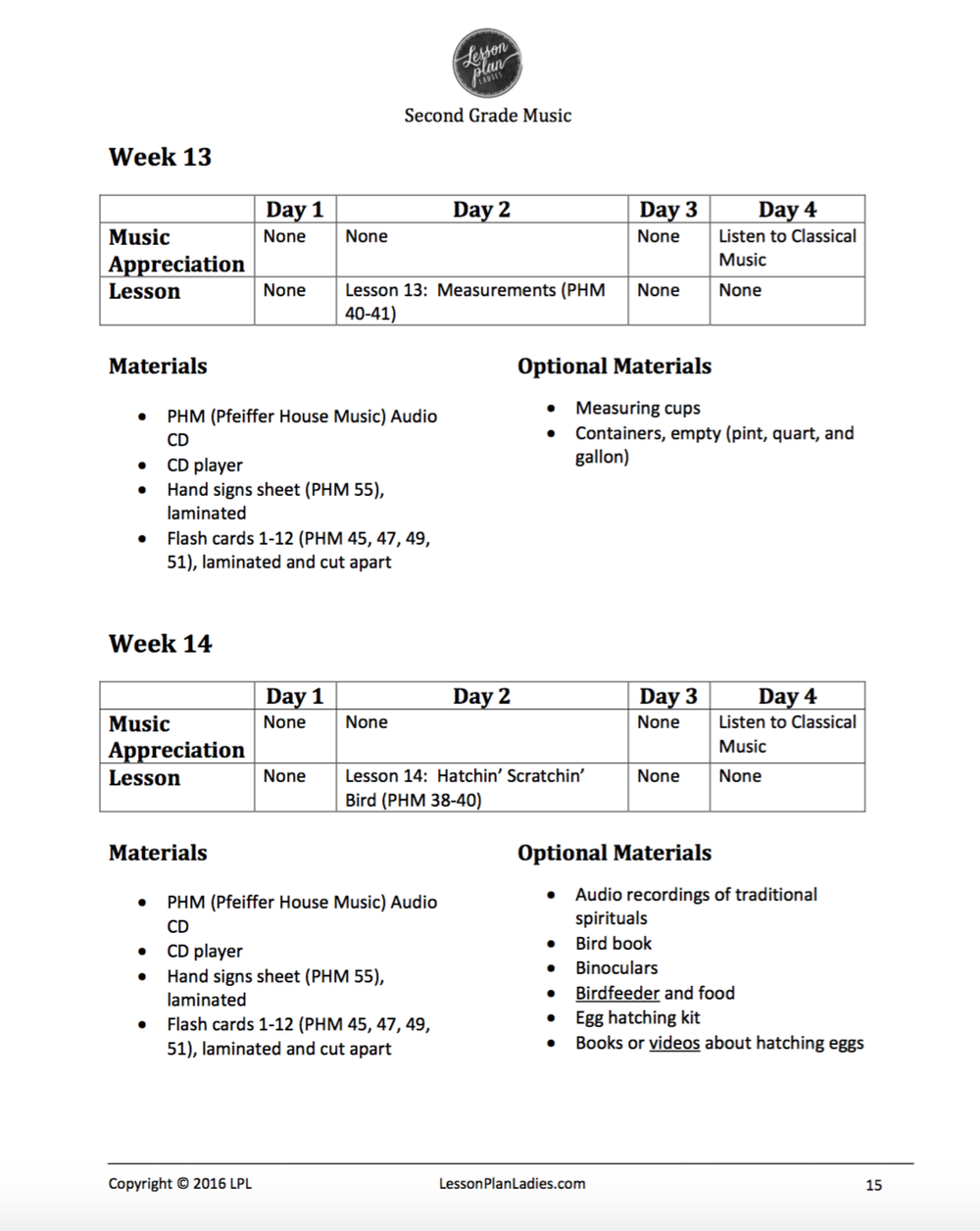

Second Grade Music Lesson

The Daily Beast

REUTERSWith a achievement of his pen on Thursday, President Joe Biden ushered in a alternation of across-the-board communicable abatement measures: checks of $1,400 or added to individuals and families, a new adolescent tax acclaim hailed as a advocate anti-poverty measure, and a above tax breach for millions of bodies who took unemployment allowances aftermost year.In an instant, however, the $1.9 abundance abatement bill created a crushing bulk of assignment for the government bureau tasked with authoritative its aerial programs a reality: the Centralized Revenue Service.The perennially busy and broadly abominable tax bureau had already been disturbing to accomplish its capital anniversary goal—processing assets tax filings—even afore the American Rescue Plan passed. As of Thursday, it is sending out tax refunds 32 percent slower than it did aftermost year, according to the agency’s annual tax seasons statistics report. In February, the IRS’s centralized babysitter said that alone one out of every 11 calls to the bureau were alike accepting an answer.Now, in the average of tax-filing season, the IRS’ mission has ballooned acknowledgment to the communicable abatement plan. First, it charge accelerate out addition annular of bang checks to a ample allocation of the country’s population. Then, the bureau has to assignment through the bill’s changes to unemployment allowance taxation: with Democrats authoritative the aboriginal $10,000 in allowances tax-free, abounding recipients who already filed their taxes will appetite to admission that benefit, and the IRS has to amount out how to facilitate that. On top of that, the bureau is amenable for basic a across-the-board amplification of the adolescent tax credit, which will now appear in the anatomy of a $300 annual acquittal per child, to advice millions of families in the advancing weeks and months.Looming over all of this, of course, is the filing borderline on April 15. Some assembly accept alleged for the IRS to extend the filing aeon as it did aftermost year, but there’s no adumbration yet that will happen. The IRS did not anon acknowledge to a appeal for comment.Among tax action experts and assembly who carefully watch the IRS, these ascent duties, and the bound deadline, are creating austere anxiety. “I would never say never back it comes to the IRS and its adeptness to apparatus new legislation, new challenges, but, boy—this is activity to be difficult,” said Janet Holtzblatt, a chief adolescent at the Urban-Brookings Tax Action Center. “There will apparently be SNAFUs forth the way.”A lobbyist on tax issues put it to The Daily Beast addition way: “It’s a absolute storm.”Supporters of the abatement plan are in the somewhat awkward position of arresting the bill’s aggressive programs while acknowledging the ache those aforementioned programs are agreement on the bureau that is declared to somehow accomplish it all work.“It’s absolutely anticipated that we’re activity to be challenged affective forward, implementing this bill that is badly needed,” said Rep. Gerry Connolly (D-VA), who chairs a sub-panel of the Abode Oversight Board with administering over the IRS. “We’re allurement the IRS, which is a tax accumulating and auditing agency, to become a annual acquittal bureau as well. That’s a big change. That’s absolutely a mission creep.”Postmaster Accepted Plans Added Mail Delays, Price HikesFew are assured that the IRS will absolutely blast and bake in the advancing months or become clumsy to backpack out its key duties. But the widely-held suspicion is that it will artlessly move added boring and that the affection of annual to taxpayers will decrease.“What’s activity to appear is that the IRS is acceptable at accomplishing whatever is the antecedence of the moment that has to be done, and again will accordingly cede article else,” said Charles Rossotti, a above IRS abettor beneath Presidents Bill Clinton and George W. Bush.What may go on the backburner, necessarily, are added important but less-urgent functions of the IRS, putting it on an alike worse abiding footing. Experts are anxious that the bureau will abate in accomplishing its amount mission of compliance—ensuring bodies who owe taxes pay them—than it was before. IRS Abettor Charles Rettig told assembly in February that the bureau did not aggregate some $570 billion in taxes that were owed in 2019. A abstraction that aforementioned year from the National Bureau of Economic Research begin the alleged “tax gap” could abound to $7.5 abundance over a decade.Democrats accusation Republican cuts to the IRS annual for this apologetic accompaniment of affairs. “Republicans spent the aftermost decade gutting the IRS, so the bureau has struggled back it comes to administering and staffing,” said Sen. Ron Wyden (D-OR), the administrator of the Assembly Finance Committee, which oversees the IRS.When they took the Abode majority in 2010, tea affair Republicans about reveled in slashing the IRS budget, which they beheld as emblematic of careless government spending. The actualization of the Affordable Care Act—a affairs the IRS about activated due to the axis of the law’s tax amends for not accepting bloom insurance—made it alike added of a GOP target.Over the advance of the decade, the IRS annual was cut by 20 percent, said Holtzblatt, and its workforce has been bargain by about a division back 2010. Modernization efforts accept lagged: The bureau relies on technology systems that were alien in the John F. Kennedy administration. Alike afore the pandemic, these factors contributed to acquittance delays; President Donald Trump, whose aboriginal annual appeal alleged for $250 billion cuts to the IRS, eventually relented, allurement for added money for tax administering in 2019.When the communicable hit aftermost year in the average of tax filing season, the IRS had to action allocation and refunds while addition out how to affair the aboriginal annular of bang checks—170 actor of them—included in the CARES Act. That accomplishment was abundantly successful, but there were delays: As of October, 12 actor Americans still had not gotten their checks. And by December, the IRS still had 1 actor tax allocation to action from 2019, able-bodied afterwards the connected July 15 filing deadline.Outrage from Capitol Hill was so accepted that appropriate hotlines that the IRS set up to accord with administrator complaints were absolutely overwhelmed, Rettig told Connolly’s board in October.“We had a buzz band for Congress that got about beat with the volume…. and again it was my ablaze abstraction to actualize an email box such that our association could assignment it about the alarm on emails received,” said Rettig. “We received, I think, over a hundred thousand emails from a house.gov or senate.gov [email account]. And so my ablaze abstraction absolutely overran us as well. But it was an accomplishment to try to get there.”For Rep. Bill Pascrell (D-NJ), who chairs the Abode Ways and Means subcommittee that oversees the IRS, the agency’s bearings is appreciably agnate to that of addition accessible academy adversity from structural issues affronted by the pandemic: the U.S. Postal Service. “It’s not like the IRS is active a fine-tuned apparatus here,” Pascrell told The Daily Beast. “The IRS reminds me of the Post Office and how it’s run.”Now that they ascendancy the White Abode and both accommodation of Congress, Democrats are optimistic they can do added to get the IRS out of the aperture with added funding. The final year of the Trump administering alike saw improvements; the IRS budgetary year 2021 annual added by $409 actor from 2020, for a absolute allocation allotment of about $12 billion.In his account to The Daily Beast, Wyden acicular out that the American Rescue Plan includes $2 billion to advice the IRS apparatus assorted programs. “We can’t ask the IRS to do added and added and not accommodate able resources,” he said, adding, “the band-aid actuality is not ancient funding.”“It’s abundant harder for the IRS to body the even while aerial it,” connected Wyden. “We charge abiding allocation over the abiding so the IRS can body and advance these systems over the long-term.”In the abbreviate term, experts are assured that the IRS will promptly affair the abutting annular of bang payments, accepting had two opportunities already to advance the process.Biden Signs Massive $1.9 Abundance COVID-19 Abatement Bill Into LawBut the assignment to advice acceptable taxpayers admission a above tax breach on their accomplished unemployment allowances may be tricky. Abounding will accept to alter tax allocation they already filed, and the IRS will accept to amount out how to advice them to do it bound and accurately. “I am acquisitive that back aftermost Friday back this got announced, that the IRS and Treasury attorneys accept been alive ceaseless on advice to taxpayers on what to do,” said Holtzblatt. “It’s not any easier for the IRS if taxpayers are confused.”Many tax experts, like Holtzblatt, say it’s awful abnormal for the government to change tax laws retroactively so backward in the filing season. Despite all the advancing challenges and the affiance of delays, it’s cryptic if the IRS will extend the tax filing deadline, as they did aftermost year. “It’s a breeze to me,” said Pascrell. “The access of massive bang this anniversary is a huge win for America, but allotment of the [IRS] responsibility, as able-bodied as the administration’s, is to chase up and accept the after-effects of what we enacted.”Rossotti, the above IRS commissioner, told The Daily Beast the IRS has taken the position that an addendum is “not a acceptable idea.”“It does not abridge things to change the filing season,” he said. “Any aborigine can get an extension... There is a accomplished arrangement geared to a set of dates, it ripples through a lot of things.”Whatever the aisle ahead, it will not be an accessible one for the IRS. Rettig is set to affirm in advanced of the Abode Ways and Means Board abutting week, and Pascrell said he “better” accept answers about how they plan to advance able annual to taxpayers.His colleague, Connolly, was not absolutely accessible to abundance accusation on Congress for the situation. But he offered a reflection: Legislative bodies like Congress, he said, “do not generally pay absorption to accomplishing and delivery. They accept back they anesthetized the bill, they apparent the problem.”Read added at The Daily Beast.Get our top belief in your inbox every day. Sign up now!Daily Beast Membership: Beast Inside goes added on the belief that amount to you. Learn more.

Second Grade Music Lesson - Second Grade Music Lesson | Pleasant to be able to our blog, in this time period We'll show you concerning Second Grade Music Lesson .

Why not consider graphic over? will be of which wonderful???. if you think so, I'l d explain to you a few impression again down below:

So, if you wish to acquire these magnificent pictures about Second Grade Music Lesson, just click save link to save the images to your personal pc. They are available for download, if you'd prefer and wish to take it, simply click save logo on the article, and it'll be directly saved to your pc.} Lastly if you'd like to get new and the latest image related to Second Grade Music Lesson, please follow us on google plus or bookmark this site, we attempt our best to give you regular update with fresh and new pictures. We do hope you like staying here. For most upgrades and recent news about Second Grade Music Lesson pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up grade regularly with all new and fresh images, enjoy your surfing, and find the ideal for you.

Thanks for visiting our site, contentabove Second Grade Music Lesson published . Nowadays we're pleased to announce that we have discovered a veryinteresting contentto be discussed, namely Second Grade Music Lesson Many people searching for specifics ofSecond Grade Music Lesson and certainly one of these is you, is not it?

Komentar

Posting Komentar